Singapore Airlines Ltd. cut Chief Executive Officer Chew Choon Seng’s salary by 20 percent and parked planes in response to a global travel slump. It didn’t touch the S$11 million ($8 million) it spends annually on wine and Dom Perignon champagne for first-class passengers.

Luring travelers back into premium seats is key for Chew to end a run of two consecutive quarterly losses, the airline’s worst streak in at least seven years. First-class and business- class passengers account for about 40 percent, or S$6.4 billion, of the carrier’s annual sales.

“Coach-class business just doesn’t produce the kind of income that will make the likes of Singapore Air profitable,” said Jim Eckes, the Hong Kong-based managing director of industry consultant Indoswiss Aviation. “High-yield traffic is ego-driven.”

Worldwide, the number of people flying in first and business class on international flights declined for 16 straight months through September, according to the International Air Transportation Association, as companies cut spending due to the recession. With the economy picking up, business is returning.

“We are starting to see bankers in suits back in first class and business class,” said Chew. The airline filled an average of 81.1 percent of its seats, including business and first class, in October, the best occupancy rate in almost two years.

“Brownie Points”

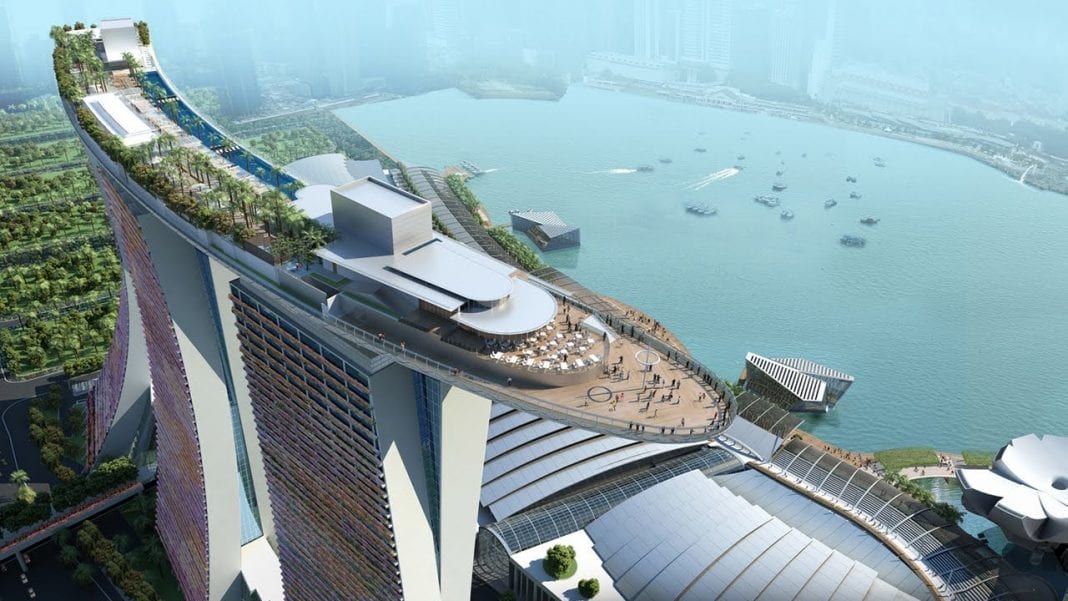

Singapore Air won the best first-class cabin award this year in a survey by London-based research company Skytrax. The private suites in its double-decker Airbus SAS A380 aircraft feature sliding doors, hand-stitched Italian leather seats and 23-inch LCD screen televisions.

“Singapore Air scores major brownie points,” said Philip Lee, Southeast Asia head of investment banking at JPMorgan Chase & Co., who flies on the carrier for business. “It is still one of the pre-eminent air carriers.”

For a S$19,000 return ticket on the A380 to London from Singapore, first-class passengers get Dom Perignon, Krug Grande Cuvee, a selection of wines from Bordeaux along with Petrossian Inc. white sturgeon caviar. The choice of meal includes lobster Thermidor with buttered asparagus, slow-roasted tomato and saffron rice; and roast breast of guinea fowl stuffed with stilton cheese in port wine sauce and potato-turnip mash.

First-class passengers also receive LVMH Moet Hennessy Louis Vuitton SA’s Givenchy pajamas and amenities kits from Salvatore Ferragamo SpA.

“Life and Death”

That’s the benchmark Korean Air Lines Co. is aiming to match as it targets the premium market, which globally accounts for as much as 30 percent of ticket revenue and less than 10 percent of passenger numbers, according to IATA. The Seoul-based carrier is spending $200 million to add flat beds, ergonomically designed seats and video-on-demand systems on some of its medium and long-haul passenger planes.

“Winning in that segment will be a matter of life and death for us,” said President Lee Jong Hee, who has said he flies as often as he can with Singapore Air to compare offerings. “We believe the future of airlines still depends on business- travel demand.”

Other carriers are cutting back on premium seats because of the demand slump. Qantas Airways Ltd., which offers sheepskin- covered mattresses for its top-paying passengers, has stopped first-class sales on routes including Sydney-San Francisco. British Airways Plc has said it may rip out some of the luxury seats it installed only three years ago in a 100 million-pound ($166 million) revamp.

Cathay Cuts

Cathay Pacific Airways Ltd., Hong Kong’s largest airline and winner of Skytrax’s best first-class award in 2008, is cutting some business-class seats on some flights in Asia to streamline service.

“There will be demand for the premium service,” Cathay’s Chief Executive Officer Tony Tyler said. “The question is will they come back in sufficient numbers, sufficient strength for us to get our yield up.”

Yields, or the average price a traveler pays to fly one kilometer, have fallen as carriers slash fares to win back passengers. Globally, carriers may lose $11 billion this year, according to IATA.

“Airlines need to see from a commercial aspect whether it makes sense to have first-class seats,” said K. Ajith, an analyst at UOB-Kay Hian Research in Singapore. “If you’re dealing with empty first-class seats, there’s an opportunity cost.”

Singapore Air, which has said it may post its first annual loss since listing in 1985, has reduced staff work-days and is cutting 11 percent of overall capacity because of the slump. The carrier reduced management salaries by 10 percent and CEO Chew’s by 20 percent.

The carrier is “wise” to maintain premium services as cuts may cost sales when demand picks up, said Kelvin Lau, a Hong Kong-based analyst at Daiwa Institute of Research.

“Politicians and pop stars still like their privacy,” he said.