The pandemic has changed so much of daily life, from how people go to work and school to how they shop and socialize. While some behaviors from this period will eventually fade away, COVID-19 has made an indelible mark on life—and travel—as we know it.

Driven by Different Motivations

Moving forward, the hotel industry will feel the impact of the ways that consumers have fundamentally changed in what they want and in how they behave and engage with brands.

Instead of focusing primarily on price and quality in making purchasing decisions, these new travelers are motivated to purchase by factors including health and safety, ease and convenience, care, trust, and reputation.

In fact, 44% of U.S. consumers say the pandemic caused them to rethink their personal purpose and re-evaluate what’s important in life, according to recent Accenture research. The same study reveals that 49% want companies to understand how their needs changed during disruptions and address these needs.

What’s more, 38% expect brands to take more responsibility for motivating them and making them feel relevant rather than only doing their

business.

When it comes specifically to hotels, new travelers place a premium on safe and sanitary environments, flexible and no-penalty booking policies, convenient customer service, sustainable products, and a positive social impact.

Many say they are willing to pay extra for these options and to switch to a different travel provider (hotels, airlines, travel agencies, and OTAs) if needed. In fact, 45% of consumers say that they are considering moving away from the travel provider they use, either completely or in part, over the next six months to a year.

The Rise of the New Leisure Traveler

Leisure travelers with these new motivations will be a significant force driving travel demand in 2022—a marked shift that began last year after years of business travel being the staple of the global travel industry.

With corporate travel policies still in flux, leisure travel will continue to recover faster in 2022, driving the hotel demand landscape. According to an analysis by Kalibri Labs, throughout 2022 leisure hotel spending will have returned to 2019 levels, but business travel will struggle to reach 80% of 2019 levels. This means the share of hotel spend by type of travel will continue to be inverted from before the pandemic; in 2019 commercial travel made up 52.5% of industry room revenue and in 2022 it is projected only to represent 43.6%.24 In fact, projections are that the summer of 2022 will be one of the strongest ever for leisure travel.

Many hotels’ business models have been primarily focused on business customer needs such as on-site dining, laundry services, exercise facilities, and business centers. The amenities that leisure travelers expect, such as spas, pools, or easy transportation to top tourist spots, have often been a secondary focus.

As such, these hotels will need to make structural changes in how they attract,

convert, and retain leisure customers.

Compared to business travelers, leisure travelers want more guidance for the booking process and more information about the destination. They buy very differently than business travelers. It’s less about specifics and convenience as it is about adding services on the fly after the initial booking in the spirit of discovery and adventure. Delivering for leisure travelers will take on added importance because there will be more of them in 2022.

The New Face of the Business Traveler

While business travel demand will lag that of leisure travel, it is not, as some have argued, a thing of the past. This is especially true in the United States, the world’s most popular business travel destination.28 Business travel overall is expected to increase in 2022 compared to last year, and, according to an analysis by Kalibri Labs, by Q3 it is projected to reach 80% of 2019 figures.29 While a full recovery isn’t expected until 2024, global business travel is projected to increase by 14% in 2022, with the United States and China seeing the largest upswing—both are projected to grow by 30%

With large managed corporate travel down— and likely never to come back exactly as it was before the crisis—small and medium-sized enterprises (SMEs) will lead the way in business travel’s recovery in 2022. This continues a trend that began in 2020 when the volume of SME travel was down but not to the same extent as the rest of business travel during the height of the pandemic.

Leaders across hotels, airlines, car rental suppliers, and travel management companies have indicated that their SME accounts came back relatively quickly coming out of 2020 and are continuing to outperform corporates today. They attribute this to the fact that smaller companies started to return to the office faster, and as part of this, put their people on the road sooner. They also believe that SME travel is buoyed by fewer travel restrictions and more flexible travel policies. These leaders are seeing growing demand from smaller consulting agencies, law and accounting firms, and retailers, and expect more of the same into 2022.

The SME sector represents an upside opportunity for hotels to fill midweek occupancy and balance highly anticipated leisure demand patterns. This is a largely untapped market—one that was often squeezed out by the largest corporate negotiated segment. For hotels to take full advantage of this opportunity, it will be important to establish contacts with prospects and understand the needs of this segment. Speed and convenience will likely continue to be important, but SME business travelers will most certainly focus on health and safety issues more so now than before.

Emerging Traveler Segments to Watch

The advent of remote work during the pandemic period—and its continued normalization since companies created flexible working environments out of necessity—has fueled the emergence of new traveler segments that blend business and leisure interests.

Bleisure travel — in which travelers piggyback leisure and business trips off each other— has been called a pandemic silver lining. While these arrangements are not new, they were more common among younger travelers before the pandemic.

Today, bleisure travel is more mainstream among business travelers across demographic groups. In fact, one 2021 study of global business travelers found 89% wanted to add a private holiday to their business trips in the next twelve months.

Some travel experts think that fly-to-the-meeting and fly-back-from-the-meeting day trips will become a thing of the past and that multi-day bleisure trips will ultimately become “the new business trip.”

This shift is possible because companies tend to be tolerant of this kind of business travel.

Digital nomads — people who have the flexibility to work from anywhere and take to the road — are also on the rise. They represent a profound rethinking of the traditional dynamic between work and travel, where people either worked

to travel or traveled for work. Digital nomads travel while they work, stopping in different destinations and staying for as long as they want, and then moving on. The availability of connectivity is essentially the only thing that limits their travel choices. Skift has reported that 3.7 million Americans are potentially positioned to live and work as digital nomads. While a niche segment today, market analysis suggests that it will be fast-growing and powerful.

We might also expect a blurring of these segments as bleisure travelers’ experiences push them to more permanent digital nomad-style ways of working.

TECHNOLOGY TRENDS TO WATCH

Technology is playing an increasingly important role in making it possible for the hotel industry to respond to travelers’ changing needs and preferences. We joined with OracleHospitality to understand the biggest technology trends expected for 2022 and beyond

- Keeping it human with technology. The personalization of technology will take

another leap forward, with hotels using digital technologies to ease workloads and

further, satisfy each individual guest with a new guest experience. This includes

everything from individual food and beverage options and flexible check-in and

check-out times to expanded room bandwidth for all traveler segments. While luxury hotels are especially known for service defined by a personal touch, hotels of all types will use more technology tools that help them “gain knowledge,” progressively enhancing guest experiences and meeting or exceeding established service standards. - Remapping the guest and staff journeys. Mobile, self-service devices are allowing

guests to navigate much of the traditional guest journey—from booking to

checkout—without having to interact directly with staff. As a result, hotel employees

are spending less time on tasks, such as processing check-ins, and can pursue

initiatives that can make a greater impact on customer service. - Shifting in-house technology solutions. For years, larger hotel chains have had in-house teams developing their own property management and central reservation

systems. But a lack of integrations, compatibility issues, and compliance issues—

along with the cost of keeping these solutions relevant and agile—creates challenges

for in-house teams. With many hotel groups restructuring during the pandemic, and

an industry-wide focus on recovery and growth, more hotels will move from in-house tools to “off-the-shelf” offerings from industry vendors. This shift will not only reduce operational costs, but also improve service offerings to employees and guests. - Expanding the use of agile PMS. Property management systems (PMS) are the hub

of hotel operations. With near exponential growth in the apps that “hang” off the

PMS, fast, simple, and low- or no-cost integrations are a necessity for continued

innovation and an efficient technology ecosystem. No PMS provider can meet the

demands of every hotelier. As a result, hotel operators will increasingly turn to a PMS solution that has a growing network of integration partners that offer expanded capabilities.

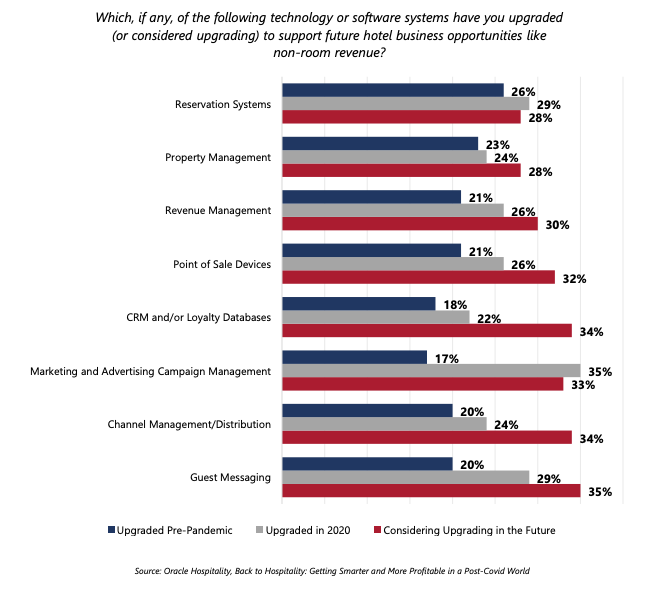

Figure 5 – Hotels Are Turning to Technology to Get Future-Ready

WHAT TO TAKE AWAY FROM THIS ARTICLE:

- Leisure travelers with these new motivations will be a significant force driving travel demand in 2022—a marked shift that began last year after years of business travel being the staple of the global travel industry.

- With large managed corporate travel down— and likely never to come back exactly as it was before the crisis—small and medium-sized enterprises (SMEs) will lead the way in business travel's recovery in 2022.

- In fact, 45% of consumers say that they are considering moving away from the travel provider they use, either completely or in part, over the next six months to a year.