- We’ve seen countries take fairly draconian positions with regard to access and international travel.

- We’re not going to see capacity return to the levels we had hoped for just a few months ago.

- If we don’t fly airplanes, we don’t get any cash. A child of three can get to those sums fairly quickly.

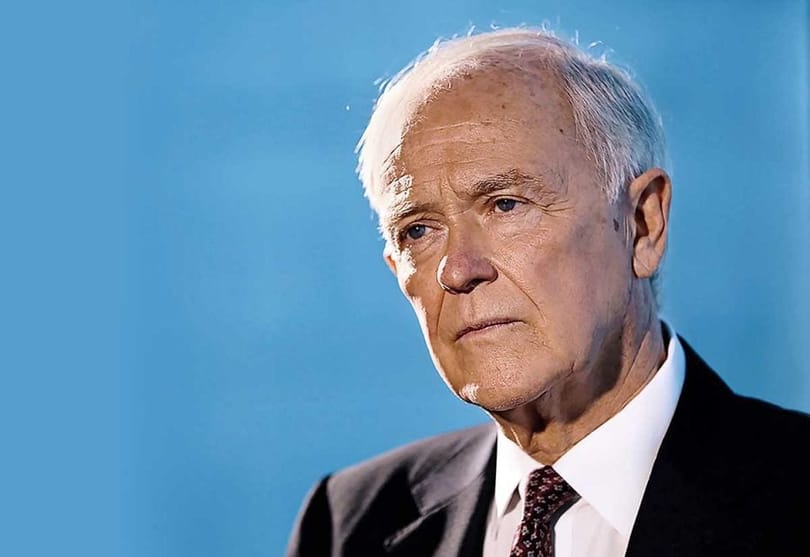

Sir Tim Clark, President of Emirates Airline, sat down with Peter Harbison of CAPA Live for an candid discussion, as he put it – during interesting times. Following is a transcript of their discussion.

Peter Harbison:

Sir Tim, let’s kick off with the big picture, where we stand at the moment through your eyes. Before we started, I was making… Before we came on, I was making the observation that there seems to be a very big difference in the risk profile, the risk tolerance that some countries are able to make in terms of, for example, the US accepting, seemingly without too much of a problem, 4,000 deaths a day, yet the industry is going ahead with 50% capacity. Contrasted with China, which very much got it under control, things under control, but during this Chinese lunar new year, the lunar new year, they’ve actually been very, very restrictive, even though there’s only been a handful of cases in China because they want to keep it under control. So, there’s this sort of tandem issue of do you proceed with growth and keep the economy going, or do you actually get the pandemic under control? And that’s obviously not a simple yes/no answer. But how do you see this panning out as it affects you at Emirates, particularly as a purely international carrier with literally hundreds of governments to deal with?

Tim Clark:

Well, of course we look at it that every day by country, and we can see as you rightly alluded to, different approaches, different imperatives with regard to how countries go about bringing this under control or balancing [inaudible 00:02:33] with opening economies, et cetera. But by and large, I would say that looking at… You mentioned the United States, looking at Europe, looking at Oceania, looking at South America, Africa, the tendency is to control first, restrict for longer, and then open when the metrics suggest that things are going to get better. And over the last 48 hours, we’ve seen countries take fairly draconian positions with regard to access and international travel. Particularly yesterday was the United Kingdom with the set rules that have been imposed with regard to quarantine. Scotland going even further. We’ve seen Canada cancel operations into North America and other places. And it goes on.

This is all driven by the fact that in the summer of last year we thought we were through it, we thought we had a handle on this virus, and then we got the mutations that came out of South Africa, or even the United Kingdom and Brazil. And they’re proving more difficult to handle, [inaudible 00:03:41] they get an understanding through the genomic sequencing of how they’re going to deal with these viruses, countries will continue to close their borders. It’ll make life more difficult for international travel. And when we last spoke in December, I think I’d said I was fairly optimistic that by the summer of this year, ’21, given that the panacea seemed to be the vaccination programs rolling out, all I was concerned about, there was a fair and reasonable way of rolling out across all parts of the geography of the planet, was that we would be able to get into some kind of meaningful restart on international travel by the summer of this year.

Again, what you’ve observed and the views that countries are taking with regard to what is the imperative, my judgment now is that it’s going to take longer than I would have hoped. And I think probably we’re going to see some difficulties. We’re not going to see capacity return to the levels I’d hoped in July and August. I think that may be in the last quarter of this year.

Peter Harbison:

That’s a challenging thought. I mean, from an airline’s point of view, obviously it’s really instinctive to want to get back flying, particularly when you’re hemorrhaging cash, and that’s been the situation with large parts of the industry. I mean, just talking to some of the Europeans last month, that was still the attitude there. We need to get flying again. We need to get through this. Whereas what you’re, I think, agreeing with me on, it’s a little bit like putting the cart before the horse. You’ve got to get things under control before you can reasonably anticipate that governments will start to take a standardized position to it. So, we’re really at least half a year, probably three quarters of a year away from that, as you see it.

Tim Clark:

Well, I think as you rightly say, the focus has returned to control of spread. Control of the virus getting into the countries at all. That is now returned as the imperative. Protect your, using the axioms of the British government, NHS, save lives, all the other things. Whereas before it was more into… I as Boris Johnson said, we’ll be getting on holiday in March, April, or whatever it was. That’s clearly changed now. In fact, they’ve gone the other way. So, the evidence is clear. There’s no point trying to think that we are going to be operating our fleets to the levels that we had hoped. And goodness me, we’re in the business of flying airplanes. If we don’t fly airplanes, we don’t get any cash. A child of three can get to those sums fairly quickly.

The problem is that the airline industry and all the associated aerospace sectors and whatever else have had a year of this now, and whereas before they… Last year people thought that, one, there would be an end in sight, two, that they would supplement the cash requirements of nonoperating by debt provision or by state aid or whatever it was, to a point where they could get through, certainly for the first quarter of this year. Well, that hasn’t happened. It looks as though it’s going to go on for longer. And, therefore, you see the cries from the heart, from a number of entities within our industry, as well as the players in the industry saying, “We’re going to run short of cash very quickly. You need to understand this.”

And I don’t see, apart from the United States, the sector specific aid, cash, that needs to go into the perfectly good businesses, nothing wrong with their models, nothing wrong with what they were doing in the past. Just they have no passengers, so goodness me, how can you… And I think we’re going to have the governments, when they get through the shock of reentering the protect and control, they’re going to have to deal with this particular issue in this sector.

Peter Harbison:

What you’re talking about there, Sir Tim, actually goes obviously a lot deeper than the airlines, doesn’t it? I guess the thing that troubles me a little bit, particularly with some of the US carriers, the big US carriers, is that, as you say, until now, we’ve been anticipating that if we held our breaths for long enough, we’ll resurface and things can start to get back to normal, particularly with the vaccine coming through. That patently isn’t the issue. This isn’t going to occur. I think you’ve just agreed with that. And as a result, rather than just trying to emerge into fresh air again with the same model you had before, is there a need to be really looking very fundamental, not just at your airline… I’m talking about you, I’m talking about the airline industry generally, the airline model itself and the whole supply chain, the interaction with lessors, the OEMs themselves, is it something that we really need, as an industry, to be talking about now? How do we adjust to a future that’s obviously not going to be the same as it was?

Tim Clark:

To your last point first, it does beg the question, what is the industry, what is the global economy going to look like post the pandemic? And there are different schools of thoughts of that, Peter, and each of those schools will shape what you think you should be doing now. If you’re of the expansionist view.

You are of the expansionist view, which is more in our neck of the woods. We take the view that you need to sort out a lot of the problems that happen, problems, issues that have been niggling you for a long time. You talked about the supply chain. You talked about the relationship with lessors, with banks, with the entities that buy into our business, which perhaps are extracting more value in the past than we would have liked. And you’ve got an opportunity to sit back and think about how you would go about improving the way you manage those particular aspects of your business, but not necessarily doing your business any differently in terms of the fundamental business model.

And yes, you’re absolutely right, there is an opportunity there. But at the end of the day, my view is that once we are through this, demand for air travel will return, consumer confidence will return. It may be slightly more finessed in the sense that people may be smarter about what they actually want. Their aspirations will be the same, but how they get the aspirations may be slightly different. They’ve had more time to think. They realize that life can go on in a different manner, and that may affect demand. I don’t quite know about that. Only time will tell.

But I’m not sure it’s the right time to start thinking about whether your business model is fit for purpose. If it was fit for purpose prior to the pandemic, then it’s probably going to be fit for purpose post pandemic. If there was a fundamental problem prior to that, then there’s no point blaming the pandemic for the fact that you failed. It was going to happen anyway, perhaps now sooner rather than later.

So those businesses that had very good, cash rich, profitable business models prior to the pandemic, I don’t see why they would be any different in terms of how their products are perceived in the market. They could be smarter. They could be more cost effective in how they do it. They could have applied digital technologies a little bit more to the fore than perhaps they had. That’ll be able to identify those areas of value that they can enhance in the business. We’ve all had time to sit around and do that. And there’s a lot of work going on in Emirates, as we speak, about what we can do in terms of the BTC relationships and how we manage the supply chain into the company. That doesn’t concern me. What concerns me more is that the ability of those industries in the same situation as we are, whether it be low cost or medium or long haul or full service, that just haven’t got the cash resource to deal with no income coming in.

And there is an obligation to ensure that this sector survives, and it’s no point to worry about state aid or who gets what. First thing, get it going. Keep it healthy and active. It’s so important to the global economy, and deal with the rest afterwards.

Also, one worries a little bit about the supply, the aerospace sectors, whether it be propulsion, whether it be manufacturing. We’ve seen some terrible situations, for instance, in Boeing recently, added to the Max issues that they’ve had. It’s certainly been a bad year, but it’s not so much the Boeings of the world we need to worry about or the Airbuses. It’s the supply chain into them. The seat vendor, [inaudible 00:12:25] manufacturers, the small industries that provide components, conduits, whatever it is. As you construct the airplanes, they rely on a huge … If they haven’t got the cash, then you’re going to have a problem with building airplanes, even though demand may return.

So, it’s a question of managing this desperately difficult situation, driven by cash more than anything else, and trying to get through that.

WHAT TO TAKE AWAY FROM THIS ARTICLE:

- And when we last spoke in December, I think I’d said I was fairly optimistic that by the summer of this year, ’21, given that the panacea seemed to be the vaccination programs rolling out, all I was concerned about, there was a fair and reasonable way of rolling out across all parts of the geography of the planet, was that we would be able to get into some kind of meaningful restart on international travel by the summer of this year.

- Before we came on, I was making the observation that there seems to be a very big difference in the risk profile, the risk tolerance that some countries are able to make in terms of, for example, the US accepting, seemingly without too much of a problem, 4,000 deaths a day, yet the industry is going ahead with 50% capacity.

- This is all driven by the fact that in the summer of last year we thought we were through it, we thought we had a handle on this virus, and then we got the mutations that came out of South Africa, or even the United Kingdom and Brazil.